Whalelend began as a family-and-friends-run investment club from Finland.

The private club admins decided to make their once private service public – and WhaleLend was born.

WhaleLend was announced to the public in July 2018 and featured GDPR compliance,

Investors might worry that this kind of high yield passive income system could be a scam, and fear risk losing all their crypto.

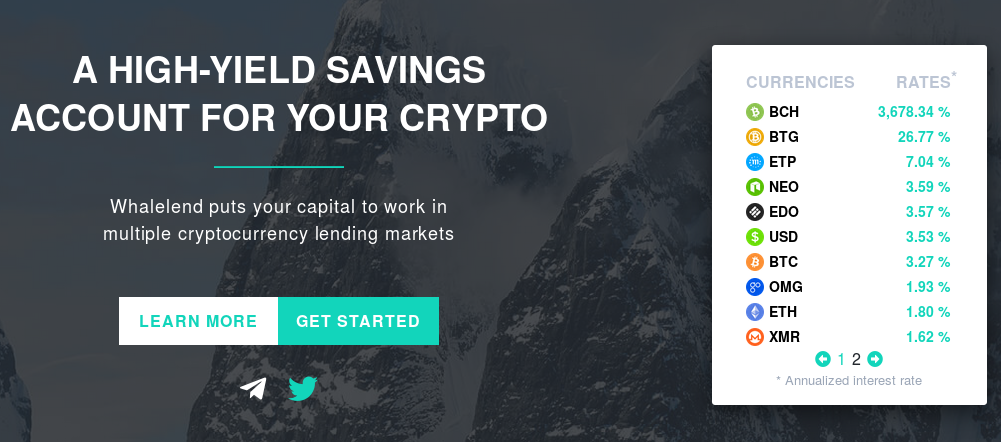

In fact, WhaleLend paid over 600% yearly rate for BCH at the time of this writing.

Which, in an age of negative yields in the most secure investments, how can anyone make such high yields?

Is WhaleLend legit? Or is it a scam?

Before joining any investment program, users should first look for real identities and real administrator profiles.

WhaleLend seems to be transparent enough about their leadership.

Their administrators’ user profiles all seem to be legit.

Namely: Yichen Wu (Founder and CEO), Chris Whellams (Founder and CTO) and Phuc Tran (Lead Engineer).

If you investigate these profiles you’ll notice that they’re legit entrepreneurs with a strong resumé.

Scam Accusations

There has been at least one thread with scam accusations posted on Bitcointalk.

It was later confirmed that WhaleLend was legit and the suspicions were not substantiated.

One thing that raised suspicions was the amount of positive reviews posted in the WhaleLend talks.

While it is possible that some paid promotion might have taken place, no foul play has been practiced by the company as a result of this marketing tactic.

How WhaleLend Works

WhaleLend works by making your funds available to investors against a high interest rate.

Note, though, that WhaleLend is not an investment fund.

When investors who trade in exchanges like Binance, BitMEX or Bitfinex wish to leverage their position, they may request to borrow funds.

This is called margin trading.

When a margin position is requested, the exchange will look to potential lenders who have enough resources to cover the demand.

If the lenders have staked their assets (which marks them as enabled for lending), the exchange will grant the requested funds to the margin borrower.

As soon as the lending operation is confirmed, the borrower begins to pay interests on the margin position.

WhaleLend works by sending your deposited crypto to such exchanges.

When users borrow those resources, you get paid the interests as if you were the lender at the exchange itself.

WhaleLend simply does the job of administrating lots of exchange accounts and taking care of margins and fund safety for you.

Currently, WhaleLend charges a 50% fee on the margin interests.

Earn Passive Income

The cryptocurrency community has long sought a trustworthy passive income financial application.

So far the only passive income solution seems to be to stake coins.

But why should this be the case, when exchanges are able to lend cryptocurrencies and generate interests?

Especially the high returns offered against Bitcoin and Bitcoin Cash deposits?

Is WhaleLend a Ponzi Scheme?

Every investment that lends to margin traders faces some risk of insolvency.

Managing this risk level is key to guaranteeing safe functioning of the financial network.

In the case where too many of the margin calls were liquidated and if WhaleLend were to take funds from newer users in order to cover the withdrawals by earlier members, it could effectively become something similar to a ponzi scheme.

Initially, though, we do not believe WhaleLend is a ponzi.

Regardless, investors should always carefully weigh their risk/return ratio.

The lending model employed by WhaleLend works by statistically minimizing risk.

If a small percentage of borrowers default and exchange problems are kept at a minimum, then the returns will likely offset the risks.

Are there risks? Yes.

The idea is to always work so the returns offset the risks. But the risks are always there.

Remember, in any lending system, if the network becomes insolvent, it essentially ends up behaving like a ponzi.

This is not particular do WhaleLend, though. It’s part of the nature of leveraged margin trading.

Who Runs WhaleLend?

WhaleLend is run by Tesseract Group Oy

Where is it located?

WhaleLend is headquartered in Finland at:

Kasarmikatu 21

00130 HELSINKI

You can verify their public records here.

Video Demo

Conclusion

WhaleLend seems to be legit.

As we stated before, any investment that is based on margin has inherent risks.

These risks should be understood by lenders.

While a well structured system like WhaleLend is not intended to be a fraud, if a perfect storm were to happen where too many margin loans were closed due to heavy losses, and borrowers became insolvent in great numbers, the system as a whole could collapse.

To defend against this, WhaleLend must protect itself by performing intense real time risk analysis and by carefully monitoring the entire lending network’s health.

Participants, therefore, depend on good risk administration by WhaleLend. If this task is performed accurately, then the returns may offset the risks and make it a worthwhile investment.

Contacts

crypto.bi - SHA256(crypto) Inc - Piazza Giordano A147 - 978 - contact@crypto.bi - We love Rome, Italy + Barcelona - 17DAB9EF880DA3BF